Market performance

The volatility that characterised the first few months of the year in equity and bond markets subsided in April. Expectations of a peak in central bank rate rises and better than expected earnings results helped push equity markets higher, despite the risks of recession. Global markets rose again in April taking the fiscal year to date gain to 9.8% in USD and the annual gain to 3.3% in USD. The turmoil in the global bank sector that occurred in March was put aside by markets. This was despite by the end of April, First Republic Bank having been taken over by JPMorgan, representing the 2nd largest bank failure in US history.

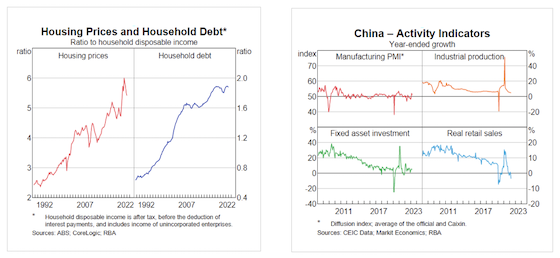

The Australian equity market did not do as well as global markets. While it rose in April, the return fiscal year to date is 5.4% and only 2.8% over 12 months. This resulted from investors turning to growth stocks and becoming cautious about domestic banks in light of concerns over the highly indebted household sector and as China’s post-Covid recovery proved underwhelming.

Uncertainty around ongoing negotiations on the US Debt Ceiling together with hawkish comments from the US Fed however caused falls in major markets in May.

Economic conditions

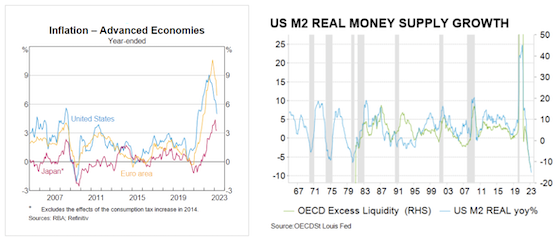

The data is mixed, and despite good news on inflation, it remains high, and there is growing evidence of recession. In the US after the failure of several banks, credit conditions are tightening, demand for loans is declining, business capital expenditure intentions are weak, consumer sentiment remains low and CEO and small business sentiment is at its lowest level since 2013. The chart on the right shows the supply of money in the US is at recessionary levels.

An area of concern in the US is that the regional/community banking sector that continues to be under pressure is by far the largest lender to the commercial property sector in the US. Many market commentators expect a significant correction in the commercial property sector that may have global ramifications. This is also the case in Europe and to a lesser extent in Australia due to very low occupancy rates in commercial buildings post COVID-19.

On the positive side, Australia’s business conditions while slowing, remain solid overall, and cost and price pressures, although elevated, are easing. Business confidence is languishing however, as is consumer confidence, as evidenced by declining retail sales (the largest 6 month decline since the 1980’s). A positive for Australia is that our banking system is fundamentally robust and very well capitalised.

According to the 2023-24 Budget forecasts, Australia’s real GDP growth is expected to slow to 1.5% in 2023-24 and remain below trend the following year. This is a significant slowdown when we bear in mind that GDP expanded by more than 20% in the previous 2 years.

Our view on the rest of 2023

From the above, you would understand that at the end of May, we still maintain our core view that there will be a global recession in the second half of 2023 led by the US, that will result in significant ongoing volatility in global financial markets. The Fed, the Bank of England and the Reserve Bank of New Zealand have all said that they are expecting some sort of mild recession. We also believe that the recession will not be a deep one and that Australia may not be impacted as much as Europe and the US. Australia, with very high levels of household debt (chart below) is dependent to a large extent on the China recovery improving (chart below) and on energy exports, which may slow in a global recession.

We find ourselves with falling inflation, which is good news, however, it is not falling to levels desired by central banks due to ‘sticky inflation’ in the service sector and wage growth from low unemployment. This is likely to reduce the appetite of central banks to reduce interest rates as quickly as markets would like. Other factors that will trigger ongoing market volatility are global governments seeking to reduce fiscal deficits and central banks wanting to reduce their balance sheets (known as quantitative tightening).

What does this all mean for portfolios?

When it comes to portfolio construction in an environment like this, we believe that the most prudent approach is to err on the side of caution. We have seen many difficult periods in the markets over the last 25 years. In uncertain times there is benefit in holding a portfolio that is well diversified by asset classes, invested in quality assets with quality fund managers and avoiding speculative and high yielding securities in the portfolio.

For those investors that are sensitive to volatility, this can also be managed by being underweight equities and overweight high-quality bonds.

Your adviser is here not simply to manage your investments, but more importantly to work closely with you to meet your goals and objectives. If your circumstances have changed, or if you would like to touch base to discuss your investments, please contact your adviser to arrange a suitable time.

The information contained in this article is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional. We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.